Down Payment Assistance Agency (DPAA)

Down Payment Assistance Florida

We're the go to source for Down Payment Assistance Florida Programs and for the Florida Hometown Heroes Housing Program through the Florida Housing Finance Corporation which helps make homeownership more affordable.

Down Payment Assistance Agency (DPAA)

Down Payment Assistance Programs Florida

Hometown Hero Program

The Down Payment Assistance Agency offers homebuyers assistance with finding programs available through the State Housing Initiative for the Down Payment Assistance Programs Florida Act. The Hometown Hero Program is open to all Florida employees working at least 35 hours per week. Learn How You Can Get Access to $35,000 for Your Down Payment to Purchase Your Home not to exceed 5% of the of the Purchase Price.

Hometown Heroes Program

For First Time Homebuyers who qualify based on income and occupation.

Down Payment Assistance

Down Payment Assistance Programs for people who make over six figures and who aren't first time home buyers.

Down Payment Financial Workshops

Get access to Financial Workshops to help you achieve your dreams.

Down Payment Assistance Course

Get Up To $35,000

You Must Complete An Approved Course to Receive Funding. Get A Bonus Course Free When You Sign-Up. "First Time Homebuyer University" Sign-Up Now to Get Funding.

Learn How to Get Access to Down Payment Assistance:

Over 100 Million Available in

Down Payment Assistance

You’re just steps away from becoming a homeowner. We’ve helped tens of thousands and now it’s your turn to enjoy homeownership!

WHO WE ARE

We have access to over 2,000 down payment assistance programs for home buyers

We are privileged to work with home buyers to help them achieve the American Dream of Home Ownership with Down Payment Assistance. Learn more about our Hometown Heroes Program.

Client Support

Client Support is available via email.

Subscribe to Our YouTube Channel

Stay Current On All Down Payment Assistance Programs for Homeownership for First Time Homebuyers and Non-First Time Home Buyers.

Down Payment Programs Florida

In Florida, there are several down payment assistance programs available for homebuyers. Some of the popular programs are:

Florida Housing Finance Corporation (FHFC) – offers several homeownership programs, including the Florida First and Florida Home Key programs, which provide down payment and closing cost assistance.

Step Up for Students – provides scholarships for low-income families to attend private schools in Florida, including K-12 and special needs schools.

City of Tallahassee’s Homebuyer Assistance Program – provides down payment and closing cost assistance to eligible homebuyers.

Hillsborough County Homeownership Program – provides down payment and closing cost assistance to eligible homebuyers in Hillsborough County.

It is recommended to check with local government agencies, non-profit organizations, and financial institutions for additional down payment assistance programs that may be available in your area.

What Are Down Payment Programs?

Down payment programs are assistance programs that provide funding to help homebuyers pay for a portion of the down payment required to purchase a home. These programs are designed to make homeownership more accessible and affordable, particularly for low- and moderate-income households.

Down payment programs can take various forms, including grants, low-interest loans, and deferred payment loans. Some programs are offered by state or local governments, non-profit organizations, or financial institutions. Some programs have income or other eligibility requirements, and some may have specific requirements for the type of home or location of the property being purchased.

The goal of down payment programs is to help reduce the upfront costs associated with purchasing a home, making it easier for individuals and families to achieve the dream of homeownership.

Down payment assistance programs play a crucial role in helping individuals and families achieve their dream of homeownership, particularly in Florida. These programs, such as the Florida Down Payment Assistance Program and the Florida H.E.R.O Home Buyer Program, provide valuable support to homebuyers by offering financial assistance towards their down payment. Designed to make homeownership more accessible, these programs prioritize certain groups, including our everyday heroes. The best heroes mortgage down payment assistance programs in Florida recognize the contributions of heroes such as veterans, first responders, and essential community workers, providing them with special benefits and incentives. These down payment assistance programs not only alleviate the financial burden of purchasing a home but also empower these individuals to invest in their future and build stable communities. By bridging the gap between savings and homeownership, these programs serve as a catalyst for individuals and families to embark on the path to realizing their homeownership dreams.

Down Payment Assistance Florida

Down payment assistance Florida programs are designed to help eligible homebuyers overcome the financial barriers of making a down payment on their first home. In Florida, there are various programs available that provide down payment assistance, including the Down Payment Grant Florida, Heroes program Florida flyer, Florida Homeownership Loan Program, and Payment Assistance Loan.

The Down Payment Grant Florida program provides eligible homebuyers with up to $35,000 in down payment assistance. This grant is a non-repayable gift that can be used towards the down payment and closing costs of a home. This program is available to first-time homebuyers and those who have not owned a home in the past three years.

The Hometown Heroes Florida Program flyer provides down payment assistance to eligible frontline community workers who have been providing essential services during the COVID-19 pandemic. This program is managed by the Florida Housing Finance Corporation (FHFC) and provides zero-interest loans to eligible heroes, such as healthcare workers, first responders, and educators, to help them purchase a home in Florida.

The Florida Homeownership Loan Program provides down payment assistance in the form of a second mortgage. The loan can be used to cover the down payment, closing costs, and prepaid expenses of a home. This program is available to first-time homebuyers, military veterans, and those who have not owned a home in the past three years.

The Payment Assistance Loan is a zero-interest loan that provides down payment assistance to eligible homebuyers. This program is available to first-time homebuyers and those who have not owned a home in the past three years. The loan must be repaid when the home is sold, refinanced, or the mortgage is paid off.

In conclusion, these down payment assistance programs can provide a significant boost to eligible homebuyers who are struggling to make a down payment. By offering grants, zero-interest loans, and other forms of assistance, these programs help to make homeownership more accessible and affordable for those who need it most.

Floridahousing.org hometown heroes offers down payment assistance programs in Florida, including options specifically designed for hometown heroes programs in Florida.

There are a variety of down payment assistance (DPA) programs available in Florida to help homebuyers with limited funds for a down payment. These programs provide a down payment assistance loan to eligible borrowers to help them with their upfront costs. Some DPA programs in Florida are offered through state and local government agencies, while others are offered through private lenders or nonprofit organizations. Many of these programs are designed to work in conjunction with other mortgage programs, such as FHA loans, VA loans, or conventional loans. By combining a DPA loan with a mortgage program, homebuyers in Florida can reduce their upfront costs and potentially qualify for a lower interest rate on their mortgage.

DOWN PAYMENT ASSISTANCE PROGRAMS FLORIDA

Down Payment Assistance Agency

We know that the homebuying process can sometimes feel overwhelming as well as exciting, but we help make the process easier by showing you step by step how to navigate to achieving the dream of home ownership with down payment assistance programs. We have more than two thousand programs available to assist with down payments and access to hundreds of millions.

City of Orlando

City of Orlando Homebuyer Purchase & Down Payment Assistance Program offers up to $40,000 towards Down Payment.

Broward County

Broward County Homebuyer Purchase & Down Payment Assistance Program offers up to $80,000 towards Down Payment.

City Of Boca Raton

City of Boca Homebuyer Purchase & Down Payment Assistance Program offers up to $95,000 towards Down Payment.

City of Tampa

City of Tampa Homebuyer Purchase & Down Payment Assistance Program offers up to $40,000 towards Down Payment.

City of Miami

City of Miami Homebuyer Purchase & Down Payment Assistance Program offers up to $150,000 towards Down Payment.

Volusia County

Volusia County Homebuyer Purchase & Down Payment Assistance Program offers up to $50,000 towards Down Payment.

Types of Down Payment Assistance Programs Florida

73% Down Payment And Closing Cost Assistance

64% of Down Payment or Closing Cost Assistance Programs Have Deferred Payments

43% are Forgivable Loans

38% of all Down Payment or Closing Cost Assistance Programs are Forgivable Loans with deferred Payments

Grants: Gifts which do not have to be repaid

Second Mortgages: Loans with very low or no interest rate where the payment may be deferred or forgiven incrementally for each year the buyer remains in the home.

Combined First Mortgage & Down Payment Programs

Down Payment Assistance Programs

11% Additional Programs

Includes matched savings programs, Housing Choice Vouchers (HCV) and other programs.

10% First Mortgage Loans

Below-market interest rates, lower or no mortgage insurance, or 100% Financing.

5% Mortgage Credit Certificates (MCCs)

Provide up to $2,000 in annual tax credits for the life of the loan.

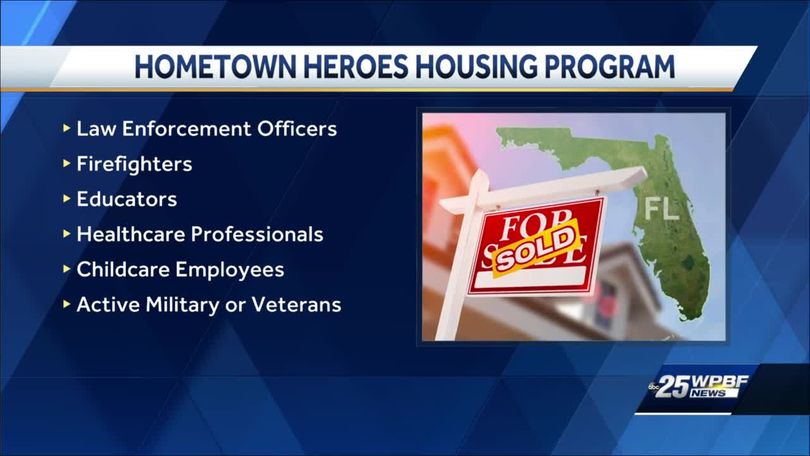

The Florida Hometown Heroes Housing Program, established by the Florida Housing Finance Corporation, is a pivotal initiative aimed at aiding eligible homebuyers among Florida’s frontline community workers, including law enforcement officers and military members, in purchasing their primary residence. This housing program is specifically designed to offer financial support through mortgage loan assistance, thereby facilitating homeownership at more manageable costs.

Under the auspices of the hometown heroes program, participants can benefit from a first mortgage loan amount that is competitive with market interest rates, in addition to receiving closing cost assistance. A standout feature of this program is the offering of a zero interest loan for payment and closing cost assistance, significantly reducing the financial burden on the homebuyer. The program stipulates a minimum credit score of 620, ensuring that applicants have demonstrated financial responsibility.

The Florida Hometown Heroes Housing Program is notable for its comprehensive approach to making homeownership more attainable for the eligible community workforce. By providing zero interest loans and emphasizing reduced upfront fees, the program directly addresses the challenges faced by potential homebuyers in securing affordable housing. The mortgage interest rate offered through this program is carefully aligned with current market rates, yet the overall package, including the Florida hometown heroes loan, is structured to minimize the financial strain on eligible homebuyers.

This heroes program is a testament to the commitment of the Florida legislature towards supporting Florida hometown heroes. By offering mortgage programs that cater specifically to the needs of Florida’s eligible community workforce, the program plays a crucial role in ensuring that the dream of homeownership is within reach for those who serve their communities. It aligns with the goal of the Florida Housing Finance Corporation to facilitate access to housing that is both affordable and conducive to the needs of hometown heroes, reinforcing the value of service to the community.

In summary, the Florida Hometown Heroes Housing Program stands as a beacon of support for Florida frontline community workers, offering a pathway to homeownership through incentives like a minimum credit score requirement, payment and closing cost assistance, and mortgage programs designed to meet the financial needs of the state’s hometown heroes. This initiative underscores the importance of accessible housing solutions for those who dedicate their lives to serving their communities, ensuring that they can secure their primary residence under favorable financial terms.

Hometown Hero Program

The Hometown Heroes Florida program provides Florida’s frontline community workers in eligible professions with down payment and closing cost up to $35,000 with limitations of 5 percent of the purchase price. An example of how the Florida Hometown Heroes Homeownership Program works is if you purchase a house for $300,000, then FHA would require 3.5% for the down payment which would be $10,500.00. The 5% of the purchase price is $15,000.00 which is maximum you would be allowed for down payment and closing cost. Now you have to subtract the 3.5% down payment that would be paid on your behalf which is done by $15,000 – $10,500.00 = $4,500.00 available or remaining that can be used towards closing cost.

The Hometown Heroes Florida program in Florida is a program that provides discounts on mortgage loans to eligible first responders, military personnel, and teachers. The program aims to recognize and reward the sacrifices and contributions made by these heroes to their communities.

Eligible heroes can receive discounts on mortgage loan origination fees, closing costs, and interest rates. The exact terms and conditions of the program vary depending on the participating lender.

To participate in the Florida Hometown program in Florida, eligible heroes must meet certain requirements, such as being a first responder, military personnel, or teacher, and providing proof of their employment or military service.

It’s important to carefully consider the terms and conditions of the program and compare it with other mortgage loan options before making a decision. It’s also advisable to consult with a financial advisor to determine if the Hometown Heroes Florida Housing program is the right choice for you. You can also learn more about the HUD First Homebuyer program for alternative homeownership options. The First Time Home Buyer Tallahassee Program Hometown Heroes is a special initiative that offers unique benefits and support to first-time homebuyers who are also hometown heroes in the Tallahassee area.

Hometown Heroes Program Florida Qualifications

The Florida Hometown Heroes Loan Program also known as Hometown Heroes makes housing affordable for eligible workers, educators and military personnel by providing down payment and closing cost assistance to qualified homebuyers. The Down Payment Assistance Agency assist Hometown Heroes by accessing lower first mortgage rate and additional special benefits to those who currently serve their communities and those who have served and continue to serve their country. Get approve for the Florida hometown heroes housing program.

There are some requirements in order to qualify for our Homebuyer Loan Program:

- Minimum Credit Score of 640.

- Must work with an approved, participating, Program Lender (click here to find an approved loan officer).

- “Approved” Home Buyer Education is required to be completed.

- Your purchase price must be below the limits for the county in which you purchase.

- Your income must be below the limits for the county in which you purchase.

- You must meet the IRS definition of a first-time homebuyer which means, you cannot have owned AND occupied your primary residence for the last three years prior to purchase.

The Hometown Heroes Program, particularly in Hillsborough County, offers a unique opportunity for the Hillsborough County first-time home buyer, focusing on providing housing for hometown heroes. This program, administered by the Housing Finance Authority, sets forth specific Hillsborough County eligibility criteria, which includes income limit criteria to ensure that those who serve our communities can access affordable housing. The initiative is designed to address the needs of individuals who fulfill vital roles within the community, making homeownership more attainable for them. Get access to homebuyer education courses.

An integral component of this program is the assistance provided on the buyer’s behalf, which significantly lowers the barriers to purchasing a home. This assistance can include help with down payments and closing costs, directly benefiting those who qualify under the program’s guidelines. Furthermore, the program offers a mortgage credit certificate to eligible participants, providing valuable tax savings and enhancing the affordability of homeownership for hometown heroes.

The criteria for an eligible property under this program are carefully defined to ensure that homes are suitable for the needs of first-time buyers in Hillsborough County. This ensures that participants have access to properties that are not only affordable but also meet quality and safety standards. By establishing these guidelines, the Housing Finance Authority of Hillsborough County aims to support those who have dedicated their lives to serving their community, ensuring they have a pathway to homeownership.

Overall, the Hometown Heroes Program in Hillsborough County, through the Housing Finance Authority, underscores a commitment to helping hometown heroes overcome financial hurdles to homeownership. By meeting specific income limit criteria and adhering to the Hillsborough County eligibility criteria, eligible first-time home buyers can benefit from significant support on their behalf, including the advantageous mortgage credit certificate, making the dream of owning an eligible property more accessible. Although the Hometown Heroes Program is for Florida residents, some of our neighbors in boarding states can benefit from off market properties in Georgia.

The Florida Hometown Heroes Loan Program is offered through “The Bond Alternative” (TBA), which helps to increase and preserve affordable housing opportunities for Florida’s frontline, emergency workers and military personnel (active duty and veterans). With TBA Program, the income and the first time homebuyer status of the borrowers(s) only is considered. This Homebuyers Program does not consider household income or the first time homebuyer status of the spouse if the spouse is not the loan. The homebuyers assistance program is concerned about Borrower(s) or parties that appear on the mortgage note.

What is the Florida Housing Hometown Heroes Program Initiative?

The Florida Housing Homeownership Program for Heroes (also known as the Hometown Heroes initiative) is a state-run program that provides special benefits and assistance to Florida residents who are active-duty military, veterans, first responders, and teachers. This program is designed to recognize and support the sacrifices that these individuals have made to serve their communities and their country.

Under the Hometown Heroes initiative, eligible individuals can receive special benefits, such as reduced mortgage interest rates, lower closing costs, and more favorable loan terms. These benefits are meant to make homeownership more accessible and affordable for these deserving individuals.

One of the key benefits of the Hometown Florida Heroes program is the reduced mortgage interest rate. This rate can be as much as one percent lower than the market rate, which can result in substantial savings for eligible homebuyers over the life of their loan. Additionally, the program provides lower closing costs, which can help homebuyers save money up front.

Another important aspect of the Hometown Heroes initiative is the more favorable loan terms. This can include longer loan terms, lower monthly payments, and more flexible credit and income requirements. These more favorable loan terms can help make homeownership a reality for many individuals who may have struggled to secure a traditional mortgage.

In addition to these benefits, the Hometown Heroes Florida program also provides educational resources and support to help eligible individuals navigate the homebuying process. This can include homebuyer education classes, financial counseling, and access to local real estate professionals who understand the unique needs and challenges of the Hometown Heroes population.

The Hometown Heroes initiative is an important recognition of the sacrifices made by military members, veterans, first responders, and teachers. By offering special benefits and assistance, this program helps to make homeownership more accessible and affordable for these deserving individuals.

Overall, the Florida Housing Homeownership Program for Heroes is a valuable resource for those who have dedicated their lives to serving their communities and their country. Whether you are an active-duty military member, veteran, first responder, or teacher, this program provides the support and resources you need to achieve the dream of homeownership.

What Are the Benefits of the Hometown Heroes Floirda Program?

One of the benefits of the Florida Hometown Heroes Loan Program is that it offers eligible borrowers a greater opportunity to purchase a home an remain in the community in which they work and serve. The Florida Hometown Heroes does NOT have an upfront 1% Origination Fee which is charged on other Florida Housing First Mortgage Loan Products. This saves the borrower(s) thousands of dollars in upfront closing costs. Lenders are not permitted to charge the standard 1% Origination Fee charged on Florida Housing’s other first mortgage program loan products. Lenders are only allowed to charge standard, reasonable and customary origination fees.

The Floirda Hometown Heroes Housing Program: Supporting Florida’s Community Workforce in Achieving Homeownership

The Florida Hometown Heroes Housing Program in Florida is a commendable initiative aimed at providing support and assistance to income-qualified buyers who are also hometown heroes. With an emphasis on promoting homeownership, this program offers various benefits such as closing cost assistance, reduced upfront fees, and competitive mortgage loan options. Let’s delve into the key aspects and advantages of the Florida Hometown Heroes Housing Program, designed to help eligible individuals purchase their dream homes.

Closing Cost Assistance and Mortgage Loan Options: One of the major benefits of the Heroes Program Florida is the provision of closing cost assistance. This valuable assistance significantly reduces the financial burden associated with purchasing a home, making homeownership more accessible to income-qualified buyers. Through the program, eligible buyers can secure a mortgage loan that covers a substantial portion of their closing costs, ensuring a smoother transition into homeownership.

First Mortgage Loan Amount and Competitive Interest Rates: The Florida Hometown Heroes Housing Program offers a first mortgage loan amount that aligns with the income and eligibility requirements of the buyers. To qualify, applicants must meet certain criteria, including a minimum credit score of 640 and the intention to use the purchased property as their primary residence. With competitive mortgage interest rates, borrowers can benefit from lower monthly payments, ultimately making their homeownership journey more affordable and sustainable.

Special Benefits for Hometown Heroes: The Florida Hometown Heroes Homeownership Program recognizes and honors the significant contributions of the eligible community workforce. The program extends additional special benefits to these hometown heroes, including reduced upfront fees and the availability of a second mortgage option. By offering these advantages, the program aims to support and encourage these dedicated individuals to achieve their homeownership dreams.

Eligibility Requirements and Local County Data: To qualify for the Hometown Heroes Homeownership Program, applicants must meet specific eligibility criteria. These requirements may include being employed by a Florida-based employer and being part of the eligible full-time workforce. The program takes into account local county data, such as the area median income, to determine eligibility and provide assistance tailored to the unique needs of each community.

Collaboration with Freddie Mac and Fannie Mae: The Hometown Heroes Housing Program works in collaboration with Freddie Mac and Fannie Mae to provide advantageous mortgage options to qualified buyers. Buyers can benefit from market interest rates and the expertise of these government-sponsored enterprises, ensuring a smooth and reliable home buying process. With reduced origination points and discount points, buyers can save thousands of dollars and receive lower interest rates, making homeownership more attainable.

Governor Ron DeSantis’s Support for First-Time Homebuyers: Governor Ron DeSantis recognizes the importance of supporting first-time homebuyers in Florida. Through the Florida Hometown Heroes Housing Program, his administration actively promotes homeownership, offering a non-amortizing second mortgage to assist first-time buyers. This additional support serves as an invaluable resource for those looking to enter the housing market and establish a secure foundation for their future.

The Florida Hometown Heroes Housing Program in Florida is an exemplary initiative that aims to provide comprehensive support to income-qualified buyers, specifically targeting hometown heroes. With its array of benefits, including closing cost assistance, competitive mortgage loan options, and reduced upfront fees, the program significantly enhances the prospects of homeownership for eligible individuals. By collaborating with government-sponsored enterprises and leveraging local county data, the program ensures tailored assistance and fosters sustainable homeownership for Florida’s community workforce. With the Hometown Heroes Homeownership Program, individuals can confidently embark on their homebuying journey and turn their dreams of homeownership into a reality. Get started today and embrace the opportunities that the Hometown Heroes Homeownership Program has to offer.

Benefits of the First Mortgage for Hometown Heroes

- The Florida First Heroes is for government back or insured loans such as FHA, VA and USDA. It offers eligible borrowers a 30 year, fixed rate mortgage. Borrowers who qualify for this mortgage program will automatically qualify for down payment assistance.

- The HFA Preferred Heroes is for TBA Conventional Fannie Mae Loans. It offers eligible borrowers a 30 year, fixed rate mortgage. This first mortgage also offers borrowers a reduced Private Mortgage Insurance (PMI) premium for borrowers below 80% AMI. Standard PMI applies to borrowers above 80% AMI. Borrowers who qualify for this mortgage program will automatically qualify for down payment assistance.

- The Florida HFA Advantage Heroes is for TBA Conventional Freddie Mac Loans. It offers eligible borrowers a 30 year, fixed rate mortgage. This first mortgage also offers borrowers at reduced Private Mortgage Insurance (PMI) premium for borrowers below 80% AMI. Standard PMI applies to borrowers above 80% AMI. Borrowers who qualify for this mortgage program will automatically qualify for down payment assistance.

Homebuyers in Florida Are Finding it Easier to Obtain Homeownership with the Heroes Program.

The keys to obtaining homeownership are within reach with the Florida Hometown Heroes Housing Program. Apply Now while funds are still available for first time homebuyers in Florida.

FL Hometown Heroes Second Mortgage

The Down Payment Assistance Agency helps prospective homebuyers who qualify for the FL Hometown Heroes TBA First Mortgage loans are eligible to receive down payment and closing cost assistance in a 0%, non-amortizing, 30-year, repayable second mortgage. This second mortgage is equal to 5% of the value of the first mortgage and is capped at $35,000.

It is worth noting, however, that this second mortgage is non-forgivable, and the borrower will be required to repay the outstanding mortgage balance in full if :

- They complete payment on the first mortgage

- They refinance the first mortgage

- Transfer the deed of the property

- No longer occupy the property as their primary residence

Hometown Hero

Celebrating Our Hometown Heroes: The Selfless Dedication of First Responders

In every community, there are individuals who selflessly dedicate themselves to the well-being and safety of others. These brave souls are known as our hometown hero or first responders. Their unwavering commitment to protecting and serving their communities is nothing short of inspiring. Let us delve into the incredible contributions made by hometown heroes, the significant impact they have on our lives, and the ways in which we can give back to these everyday heroes.

The Role of Hometown Hero Program: The Hometown hero is specifically first responders, who play a critical role in maintaining public safety. These courageous men and women include police officers, firefighters, emergency medical technicians (EMTs), and paramedics. They are the first to arrive at the scene of emergencies, putting their lives on the line to rescue and protect those in need. Their ability to remain calm under pressure and provide timely assistance often makes all the difference in life-threatening situations.

The Importance of Recognition: It is crucial to recognize the extraordinary efforts of our hometown heroes. Their sacrifices and dedication to the well-being of the community deserve acknowledgment and appreciation. Their service often goes unnoticed, but their impact on the lives of others is immeasurable. By acknowledging their hard work, we not only show our gratitude but also motivate them to continue their noble efforts.

Ways to Give Back: There are various ways in which we can show our support and give back to our hometown heroes. One simple yet effective method is expressing gratitude by saying “thank you” whenever we encounter a first responder in our daily lives. Communities can organize events and gatherings to honor and recognize these brave men and women, showing them that their efforts are deeply appreciated.

Additionally, donating to charities that support first responders or their families can be an excellent way to give back. These organizations provide assistance to the families of fallen heroes or support programs aimed at improving the lives of active duty first responders.

The Hometown hero, especially first responders, embody the true essence of selflessness and service to others. Their contributions make our communities safer and our lives more secure. By recognizing their efforts and expressing our gratitude, we can give back to these everyday heroes who continually put their lives on the line for the greater good. Let us remember to appreciate and celebrate our hometown heroes, for they are the embodiment of courage and compassion in our communities.

Down payment assistance programs are designed to help potential homebuyers with limited financial resources achieve their dream of homeownership. One such program is the Hero Home Buyer Program, also known as the Florida Hometown Hero Housing Program, which provides assistance to first-time homebuyers who are police officers, firefighters, teachers, and other essential workers.

To apply for the Hero Home Program or Hometown Hero Homeownership Program, applicants must meet certain eligibility criteria and complete the necessary application process. The program provides financial assistance in the form of down payment and closing cost assistance, which can help reduce the upfront costs associated with buying a home.

The program provides a first mortgage loan amount that is typically financed through Freddie Mac first mortgage loans with low-interest rates. In addition, the program offers zero interest loans for the down payment and closing costs, which can significantly reduce the financial burden on eligible homebuyers. If you have already started to save for you home, Learn which are the safe banks to put your money in with strong financials.

The Hero Home Buyer Program is especially beneficial for police officers, who often struggle to save enough money for a down payment due to their relatively low salaries. The program provides police officers with the opportunity to own their own home and build equity over time.

To participate in the program, applicants must work with a participating loan officer who can guide them through the application process and provide them with information about the available down payment assistance options. The loan officer will help the applicant understand the program’s requirements and assist with completing the application. Learn more about alternative programs such as HomeReady.

In conclusion, down payment assistance programs such as the Hero Home Buyer Program and Hometown Hero Homeownership Program can be an excellent way for police officers and other essential workers to achieve homeownership. These programs provide financial assistance in the form of down payment and closing cost assistance, which can help reduce the upfront costs associated with buying a home. By working with a participating loan officer and completing the application process, eligible homebuyers can take advantage of these programs and achieve their dream of owning a home.

In Jacksonville, FL, eligible homebuyers can take advantage of the Heroes Loan Program Florida, which provides substantial down payment assistance of up to $35,000. This Florida-approved program aims to support and honor local heroes, such as healthcare professionals, first responders, and educators, who contribute immensely to their communities. The Heroes Loan Program Florida offers a specialized loan known as the Hometown Heroes Loan, designed to help these heroes achieve homeownership.

The Florida Down Payment Assistance Program is an integral part of the Hometown Heroes Loan program, providing eligible homebuyers with the financial support they need to cover their down payment requirements. This program is tailored to assist income-qualified individuals and families, ensuring that homeownership becomes more accessible and affordable.

Through the Hometown Heroes Loan program and the Florida Down Payment Assistance Program, eligible individuals in Jacksonville, FL, can receive significant financial assistance towards their down payment. This assistance can alleviate the upfront costs associated with purchasing a home and ultimately help turn the dream of homeownership into a reality for hometown heroes.

By providing dedicated loan options and down payment assistance, the Hometown Heroes program in Jacksonville, FL, serves as a vital resource for local heroes looking to invest in their own homes. This program recognizes the incredible contributions of these individuals and aims to support their homeownership aspirations, creating stable and thriving communities throughout the area.

Florida Hometown Heroes Housing Program

The Florida Hometown Heroes Housing Program, available through www.floridahousing.org, is a commendable initiative designed to support local heroes and enhance homeownership opportunities. The program is a result of the Hometown Heroes Bill Florida, also known as the Downpayment Toward Equity Act. Through this act, eligible individuals can receive down payment assistance, making homeownership more achievable. To ensure responsible homeownership, the program mandates government-approved homeownership education for participants. Aspiring homeowners can seek guidance from a mortgage lender to explore the various affordable housing programs available through the Florida Hometown Heroes Housing Program. This initiative not only helps heroes in their journey towards homeownership but also promotes community development and reduces reliance on rental properties, fostering a sense of stability and pride in their local communities.

For those searching for commercial real estate loans, we recommend you visit Capital Group who specializes in private money lending, business loans and bridge loans. If you’re a home owner looking to sell your home fast in Florida, then we recommend Home Trusts. Learn how you can acquire off market properties and access private money lenders.

DOWN PAYMENT ASSISTANCE FOR COMMUNITY SERVANTS

Hometown Heroes Program Florida

Florida newest down payment assistance program to help make homeownership more affordable for frontline community workers such nurses, firefighters, law enforcement officers and over 100 other positions.

User Rating

HOME TOWN HEROES HOUSING PROGRAM

Home Town Heroes Loan Program

HOMETOWN HEROES HOUSING PROGRAM FLORIDA

Down Payment Assistance Programs Florida

HOMETOWN HEROES LOAN PROGRAM FLORIDA

Down Payment Assistance Programs Florida

“We’re extremely proud to share this milestone because it demonstrates how much the Home Town Heroes Loan program is already helping hardworking Floridians throughout the state,” said Trey Price, Executive Director of Florida Housing Finance Corporation.

HOMETOWN HEROES LOAN PROGRAM FLORIDA

Down Payment Assistance Programs Florida

Florida Housing Market Overview

$391,300

Median Sales Price

Up 10.1

%Year-Over-Year

24,517

# of Homes Sold

11/2022

FL Housing Market

HOW WE WORK WITH THE FLORIDA HOUSING FINANCE CORPORATION?

Working together to help our Hometown Heroes in Florida Achieve Homeownership

Down Payment Assistance & Closing Cost Assistance

1. Complete Live Database Form

Based on the data you provide as far as household members, income and location, etc. The system will find you down payment money available to you.

2. Down Payment Programs

Within seconds you will see usually multiple down payment assistance programs you qualify for sent you via email directly with the amount of money available.

OUR PROCESS

How To Find Down Payment Assistance Programs

We are here to make the process easier with cutting edge technology

to find any down payment assistance money available in every county in the state of Florida.

3. License Mortgage Loan Officer

After you receive the down payment assistance programs you qualify for, you will then receive a license mortgage loan officer contact information to help you.

OUR ACTIVITIS

Latest Blog Update

We are privileged to work with hundreds of future-thinking businesses, including brands.